WARC, the global marketing intelligence service, released its latest report that highlights the rise in advertising spending on e-commerce platforms- as brands look to capitalize on the boom in online shopping, as a result of the Covid-19 outbreak. Advertising investment across e-commerce sites such as Amazon, Tmall and Rakuten, omnichannel retailers such as Walmart and Carrefour, and social commerce on platforms such as TikTok is set to increase 18.3% worldwide, growing 30 times faster than the wider online ad market and in stark contrast to a forecast fall of -8.1% for the total advertising industry this year.

The uptick in e-commerce advertising spending mirrors the rapid increase in online purchasing. Consumers will spend an additional $183bn online this year as a direct result of Covid-19 with total e-commerce sales set to rise by 30.4%. Brands are flocking to leverage targeted advertising across e-commerce platforms as a means of getting closer to the consumer at the point of purchase. Here are the key findings-

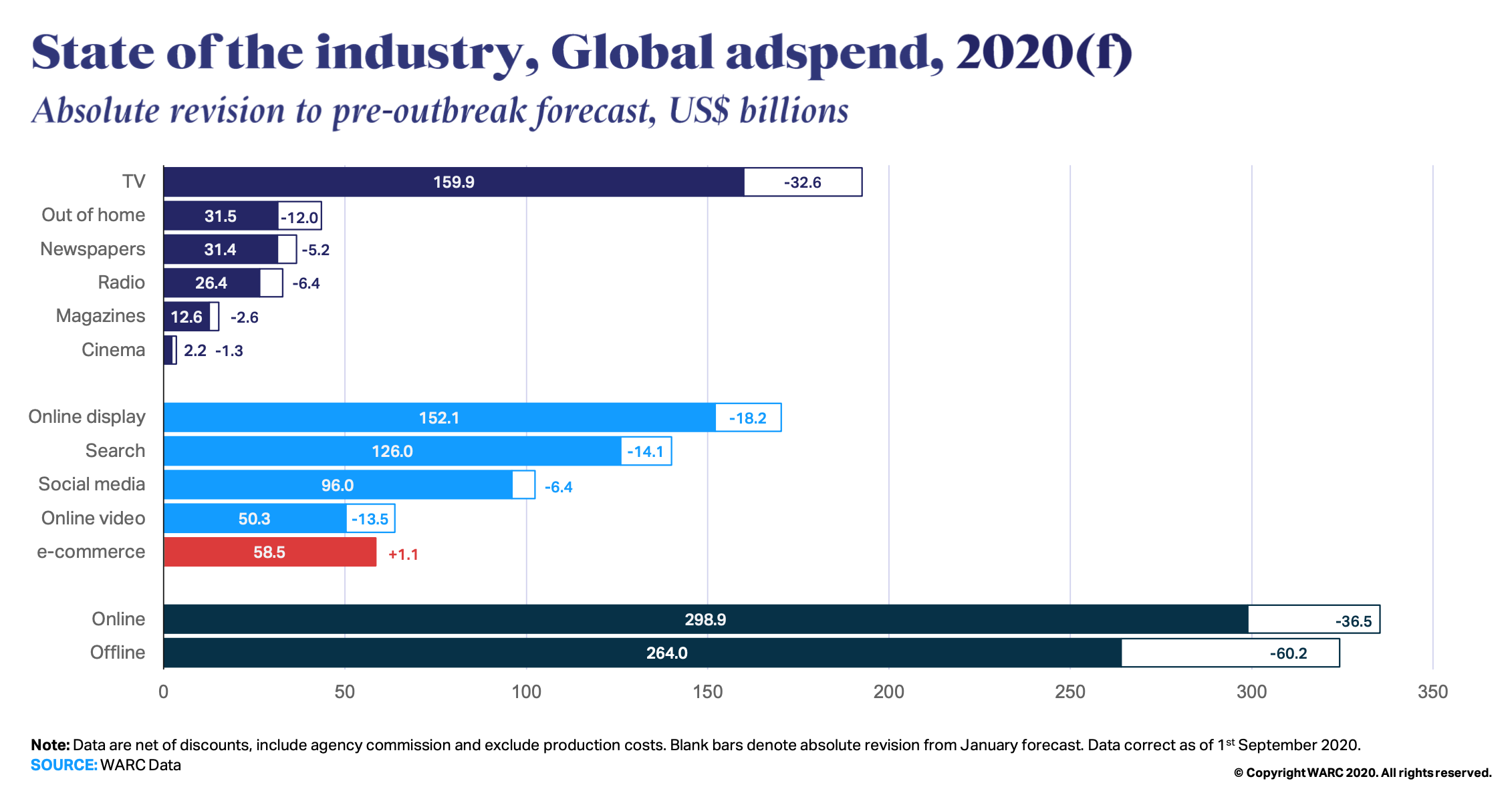

Brands are set to spend $59bn on e-commerce advertising this year

- Ad investment across e-commerce sites, omnichannel retailers, and social commerce is growing 30 times faster than the wider online ad market as brands intensify lower-funnel tactics in response to COVID-19.

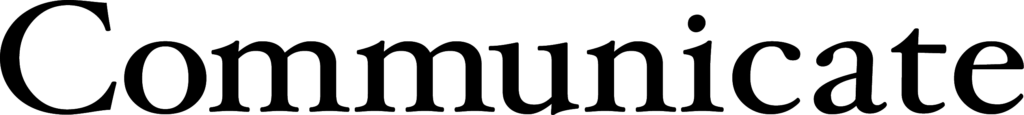

- This growth has coincided with a sharp fall in spending across major media.

- Growth in e-commerce is far exceeding that of other media and formats, including the wider internet.

- Adspend is set to rise 18.3% this year, compared to a 0.6% rise for total internet and an 8.1% decline across all media

- Ad formats vary, though this money is typically spent on sponsored keyword search, targeted display ads on e-commerce sites, and social/ live-stream commerce.

The ad-market is playing catch up

- Prior to 2020, ad investment across all internet formats was growing at a similar rate to e-commerce sales value worldwide.

- The break in the correlation this year may be reflective of the growing availability of e-commerce ad inventory, offering a route for brands seeking to get closer to the point of purchase.

- With digital advertising spend plateauing in the wake of Covid-19, e-commerce platforms – which have seen penetrations balloon – are in a strong position to capture reallocated budgets by using sales data, to demonstrate ad performance and ROI during a volatile economic climate.

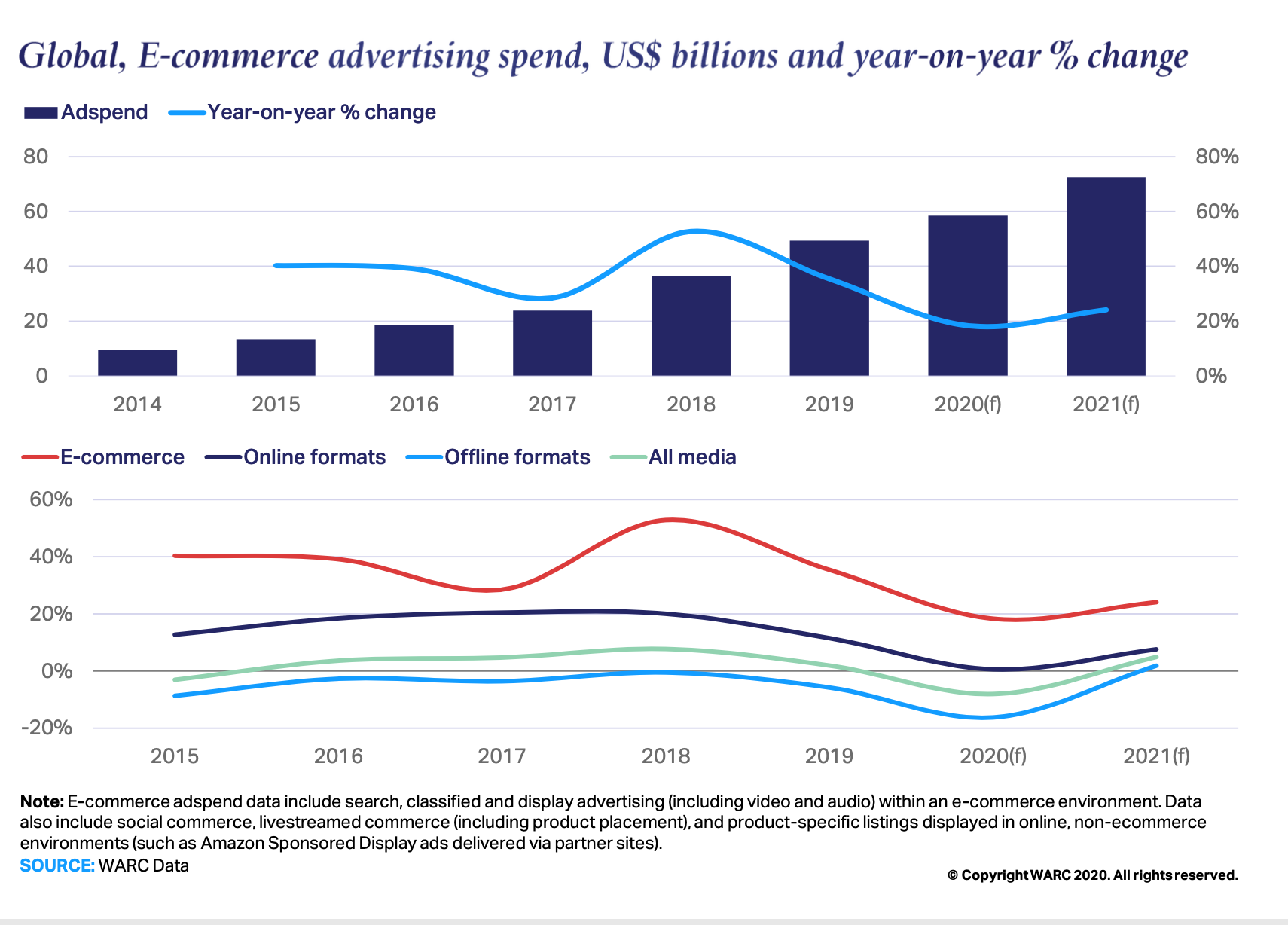

Alibaba controls the world’s third-largest ad business

- The Chinese e-commerce giant is set to make $23.5bn from selling ad inventory across its e-commerce properties this year, a rise of 6.6% from 2019.

- This gives Alibaba control of the third-largest advertising business globally, behind only Alphabet and Facebook.

Amazon’s ad business is growing 4.5 times faster than Facebook’s and 63 times faster than Alphabet’s

- Amazon stands to make $18.1bn in 2020 – up 35.6% from 2019.

- Practitioners are benefitting from data-rich trading environments, with ROAS growing every month this year.

Covid-19 will result in an additional $183bn being spent online by consumers this year

- Taken together, e-commerce sales are set to rise by 30.4% – $677bn to $2.9trn this year, with consumer packaged goods being the primary benefactors.

- FMCG ad money is also shifting online in response to buying patterns.

Livestreams are growing to account for a fifth of Chinese e-commerce

- The largest three platforms – Taobao, TikTok, and Kwai are seeing over two-thirds (69.1%) of their sales from live streams this year.

- Practitioners are lacking the benchmarks to inform adequate campaign measurement and this is hindering strategies.